INSIGHT: Global cauldron of concerns bubbles amid BASF profit warning

ICIS News | December 13, 2018

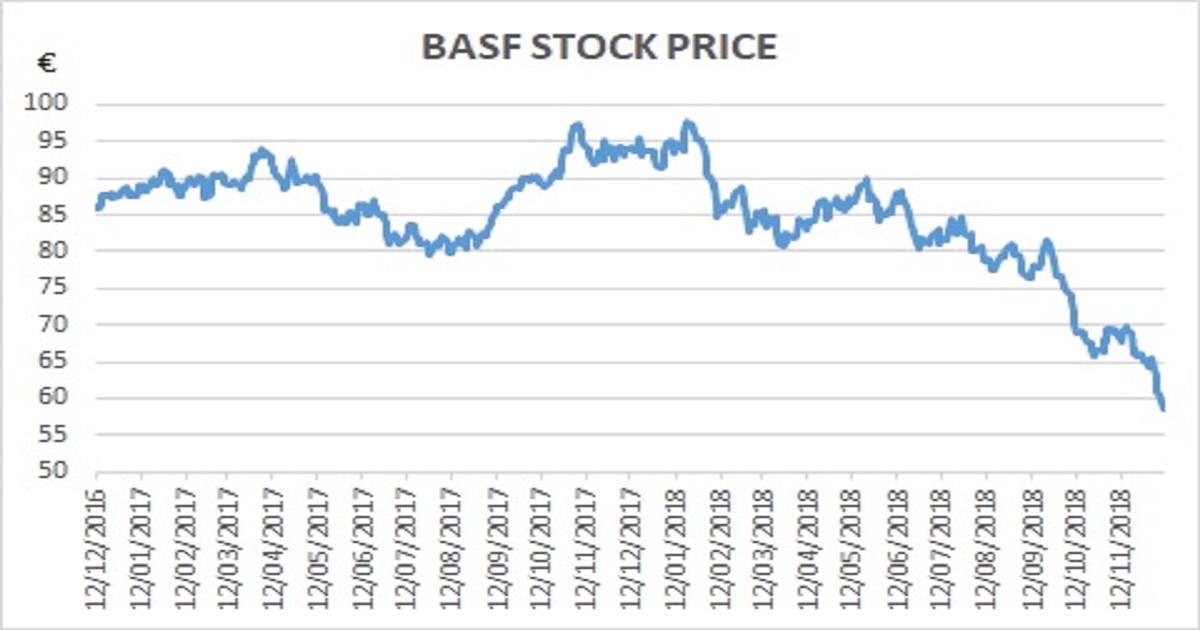

NEW YORK (ICIS)--A bevy of uncertainties, stemming from US Federal Reserve rate hikes, late economic cycle dynamics, the US-China trade war, Brexit, Italy’s budget crisis and the mass protests in France, are weighing on global business sentiment. While US manufacturing activity continues to march ahead for now, growth in Europe and China is screeching to a halt, as evidenced by their respective purchasing manufacturing indexes (PMIs). A profit warning from Germany-based BASF, the world’s largest chemical company, outlines the challenges ahead. Weakness in the overall automotive sector, and particularly in China, was one of the key factors in BASF’s outlook for underlying operating profit in 2018 plunging 15-20% year on year. BASF had earlier projected a 10% decline in operating profit. The company cited the US-China trade conflict as a contributing factor to the automotive slowdown. Shares of BASF, already down to more than a 2.5-year low of €60.69 when the warning was announced on 7 December, fell another 3.8% to €58.40 by 10 December.